My Top 3 Picks

The go-to accounting software for small businesses, with robust features and a user-friendly interface.

A top choice for startups, offering a wide range of accounting features, customizable invoices, and integration with other business tools.

Designed for freelancers and service-based businesses, with easy-to-use invoicing and time-tracking features, plus integration with popular payment platforms.

Alright guys, hold onto your wallets because we’re about to talk about the financial revolution that’s sweeping the nation. It’s time to ditch the old-school paperwork and spreadsheets, and jump aboard the automated accounting software for startups.

Back in the day, companies were drowning in a sea of paperwork and spreadsheets, struggling to keep up with their finances. It was a grim, manual existence, to say the least. But thanks to the wonders of modern technology, accounting software has become a game-changer for startups looking to stay ahead of the curve.

Today, accounting software is more powerful than ever, with advanced features and automation capabilities that were once just a dream. From generating invoices to monitoring cash flow and even forecasting future financial trends, these software solutions are transforming the way startups handle their finances.

I’ve done the dirty work for you and put together a list of the 9 best accounting software systems that will kick your financial management game up a notch. So buckle up, because it’s time to take your startup’s finances on a wild ride to success!

The Best AI Marketing Tools In 2023

1. QuickBooks

Best For Monetization

What better way to kick things off than with QuickBooks. This software is one of my top accounting choices for startups and medium-sized businesses. It’s not just me, it’s dubbed the #1 small business accounting software for a reason. Using it is like having a personal accountant in your back pocket, but without the ridiculous hourly fees.

With QuickBooks, you can wave goodbye to the headache of manually generating invoices and tracking expenses. This software takes care of it all for you, leaving you with more time to focus on what really matters – like brainstorming your next big business move or catching up on the newest episodes of Succession.

But don’t take my word for it. Give QuickBooks a try and see for yourself why it’s the best accounting software for startups looking to take their finances to the next level. I know accounting isn’t the most fun aspect of running a business, so invest in something that makes that part of your day easier.

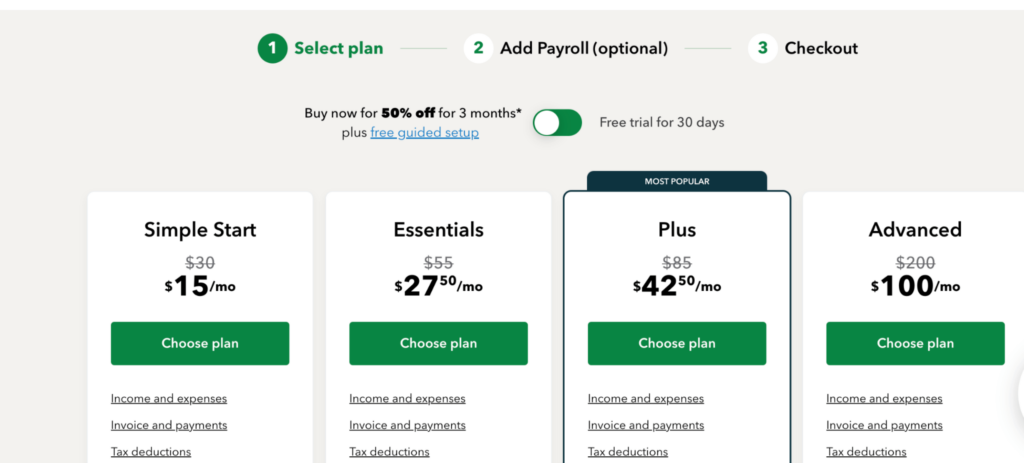

Pricing

- Simple Start: The Simple Start package is priced at $15/month, which is perfect for a new startup business. It includes essential features such as tracking income and expenses, custom invoices and quotes, bank connectivity, and even the ability to keep track of GST and VAT. One user only.

- Essentials: This Essentials package is $27.50/month and includes all of the features in Simple Start, as well as the ability to manage bills and payments, track employee time, and work in multi-currency. It also allows up to three users, plus your accountant.

- Plus: Plus is the ultimate package for growing businesses, sitting at $42.50/month. It includes all of the features in Essentials, plus the ability to manage recurring financial transactions and bills, track inventory, and manage budgets. It even allows up to five users, plus your accountant.

- Advanced: The Advanced plan is the most comprehensive package priced at $200 per month. This plan includes all the features of the Plus plan, as well as advanced inventory tracking, project profitability analysis, and business analytics with Excel. It also allows for more than 5 users, making it ideal for larger organizations.

Pros

- 50% off for the first 3 months

- Easy to use, even for those without a finance background

- It integrates smoothly with other systems

- Has flexible 3rd party applications that can be added to enhance its functionality

- Generates excellent accounting reports that provide valuable insights into your startup's financial health

- User-friendly interface that allows users to quickly find and fix errors/mistakes

- Great customer support

Cons

- Lacks project management or human resources

- Instability and system crashes have been reported, which can be frustrating for users who rely heavily on the software

- Does not offer direct professional support, which may be a drawback for businesses that require immediate assistance

- QuickBooks has file-size issues, and there are limitations on the number of transactions that can be processed, which can be problematic for growing businesses

- The software also has limitations on the number of users that can access the platform, which can be a problem for larger companies

Quick Summary

Who’s it for?: Small and medium-sized businesses looking for an efficient and user-friendly accounting system that has a great reputation.

How much it costs: Plans start at $15/month.

Key features:

- Tracking income and expenses

- Custom invoices and quotes

- Bank connectivity

- GST and VAT tracking

- Insights and financial reports

- Receipt capture and organization

- Progress invoicing

- Bill and payment management

2. Zoho

Best For Keeping Sales Prospects In Track

When it comes to online accounting software for startups, Zoho Books is the top dog in my book. Its sleek and intuitive interface makes it a joy to use, and the automation and collaboration features are like Batman and Robin, unstoppable.

One of the things I appreciate about Zoho Books is the wide range of accounting features that it offers, from tracking expenses and invoicing to managing inventory and generating reports. The software provides comprehensive financial insights and makes it easy to keep track of all my business finances in one place.

Another standout feature is the level of customization available in the platform. Zoho Books allows users to personalize invoices, estimates, and other documents with their own branding and design. Plus, the mobile app is just as impressive as the desktop version, enabling me to work from anywhere at any time. Zoho has an impressive range of products, including invoicing, so you should definitely check those out too.

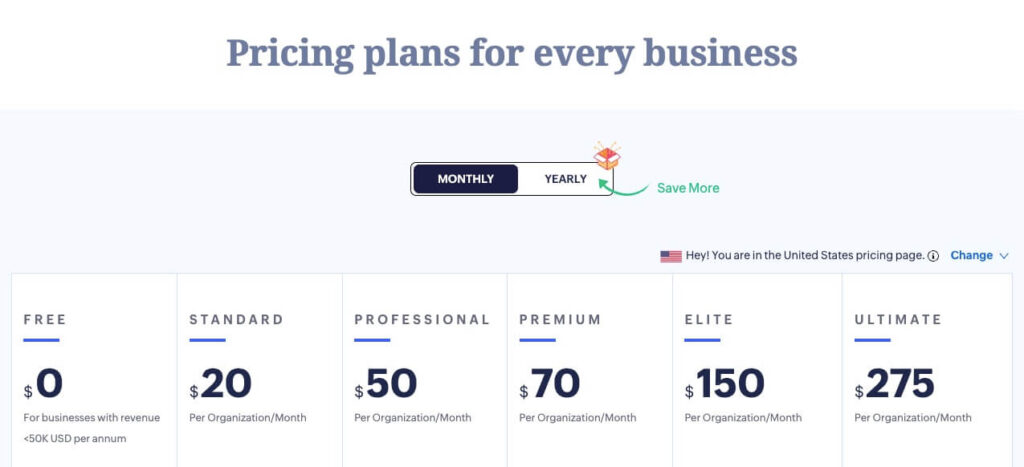

Pricing

- The Free Plan: Their free plan is suitable for businesses with an annual revenue of less than $50,000 and includes features such as invoicing, payment reminders, expense tracking, and reports.

- The Standard Plan: The Standard plan, which costs $20 per month, includes everything in the free plan plus additional features such as account reconciliation, project tracking, and VAT MOSS report.

- The Professional Plan: The Professional plan costs $50 per month and includes everything in the Standard plan plus sales and purchase orders, stock tracking, and workflow rules.

- The Premium Plan: The Premium plan, which costs $70 per month, includes everything in the Professional plan plus advanced features such as a custom domain, budgeting, and advanced inventory control.

- Elite & Ultimate Plans: The Elite and Ultimate plans offer even more advanced features, such as unlimited custom reports and advanced analytics, and are priced at $150 and $275 per month, respectively.

Zoho Books also offers various add-ons, such as additional users and branches, as well as advanced auto scans.

Pros

- The free plan makes it accessible to small businesses with limited budgets

- The software boasts a robust mobile app that enables users to manage their finances from anywhere

- Impressive support options, including email, voice, and chat

Cons

- The software is limited to a maximum of 10 users, which may not be sufficient for larger organizations

- Some of the more advanced features are only available in higher-level plans, which may be costly for small businesses

- Zoho Books has limited integration options, which may not be ideal for businesses that rely heavily on other software solutions

Quick Summary

Who’s it for?: Small to medium-sized businesses looking for an affordable accounting software with various plan options to meet their specific needs.

How much it costs: Plans start at $0/month for businesses with revenue less than $50K USD per year, with pricing for higher-level plans ranging from $20/month to $275/month.

Key features:

- Automated payroll processing

- Invoice and expense tracking

- Bank and credit card account integration

- Multi-lingual invoicing

- Customizable reports and templates

- Department and project tracking

- Inventory control and management

- Various payment gateway integrations

- Customer and vendor portals

- Advanced features such as retainer invoices and workflow rules available in higher-level plans

3. FreshBooks

Best for Invoicing and Time Tracking

If you’re a freelancer or independent contractor, then FreshBooks may just be the answer to your prayers.

With its solid phone support and customizable invoicing features, FreshBooks is well-suited for small businesses looking to streamline their financial management processes. But let’s not be hasty; while it may be a great choice for some, it’s not ideal for all.

Fast-growing businesses may struggle with FreshBooks’ user and client limits on some of its plans. However, for freelancers and independent contractors, FreshBooks’ intuitive and easy-to-use interface is a breath of fresh air. Say goodbye to the headache of manually generating invoices and tracking expenses; FreshBooks takes care of it all for you.

And if you’re worried about the learning curve, don’t be. FreshBooks’ software is easy to navigate, even for the technologically challenged. You don’t have to be a finance expert to use FreshBooks; it’s designed with simplicity in mind.

But perhaps the best thing about FreshBooks is its ability to grow with your business. As your needs change, FreshBooks’ customizable features can adapt to fit your specific requirements. You can easily upgrade your plan to gain access to more advanced features such as time tracking, project management, and even double-entry accounting.

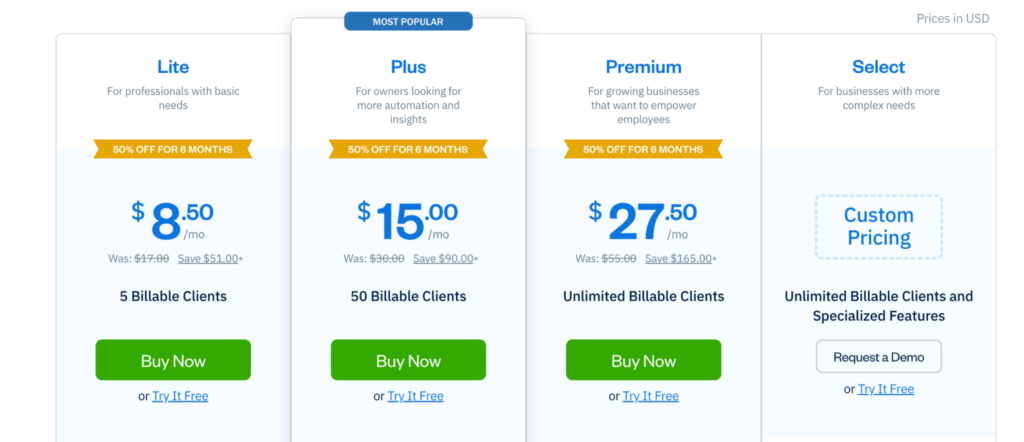

Pricing

- The Lite Plan: The Lite plan is ideal for professionals with basic needs, such as freelancers or independent contractors, and is priced at $8.50 per month. This plan includes features such as unlimited invoices to up to five clients, tracking unlimited expenses, sending unlimited estimates, and getting paid with credit cards and bank transfers.

- The Plus Pan: The Plus plan, priced at $15 per month, is the most popular option, with advanced automation and insights that can benefit small business owners. This plan includes all of the features in the Lite plan but allows up to 50 billable clients, automatically tracks expenses, sends late payment reminders, and provides double-entry accounting reports.

- The Premium Plan: The Premium plan, priced at $27.50 per month, is ideal for growing businesses that want to empower employees. This plan includes all of the features in the Plus plan but allows unlimited billable clients, tracks bills, bill payments, and vendors with accounts payable, and customizes email templates with dynamic fields.

- The Select Plan: For businesses with more complex needs, FreshBooks also offers a Select plan with specialized features, such as lower credit card transaction rates, custom onboarding services, and a dedicated account manager, with custom pricing.

Pros

- User-friendly interface that makes it easy to navigate and use the software

- Customizable invoicing features, including the ability to add your logo and branding, choose from different templates, and automatically bill clients for recurring projects

- Mobile app that allows you to track time, send invoices, and manage expenses on-the-go

- Excellent customer support, with phone, email, and chat support available

Cons

- Some advanced accounting features, such as double-entry bookkeeping, are not available

- Limited number of clients allowed on some plans, which may be problematic for businesses with a high volume of customers

- Limited integrations with other business tools and software

Quick Summary

Who’s it for?: Small to medium-sized businesses looking for an affordable accounting software with various plan options to meet their specific needs.

How much it costs: Plans start at $8.50/month for businesses with up to 5 billable clients, with pricing for higher-level plans ranging from $15/month to custom pricing for businesses with more complex needs.

Key features:

- Automated invoicing and payment tracking

- Expense tracking and reporting

- Integration with payment gateways

- Multi-currency support

- Mobile app access

- Time tracking and project management

- Customizable invoice templates

- Team member and client collaboration

- Late payment reminders and fees

- Limited user and client limits on some plans

4. Neat

Best For Managing Receipts and Documents

Alright, folks, let’s keep the financial party going with Neat, another next level accounting software for startups. If you’re tired of the headache of document retrieval and data entry, this software might just be your new BFF.

Neat offers a solution to the dreaded document loss problem. No more sifting through piles of paper during tax time, my friends. With Neat, all of your important financial statements are stored in one secure location, making keyword searches and filtering a breeze. Plus, you’ll reduce manual data entry, which means more time for happy hour with the team.

And the collaboration features? They’re off the charts. Say goodbye to those pesky large email attachments and hello to seamless communication with your clients on any device. Share files and comment on documents without missing a beat.

So kick back, relax, and let Neat take care of the dirty work.

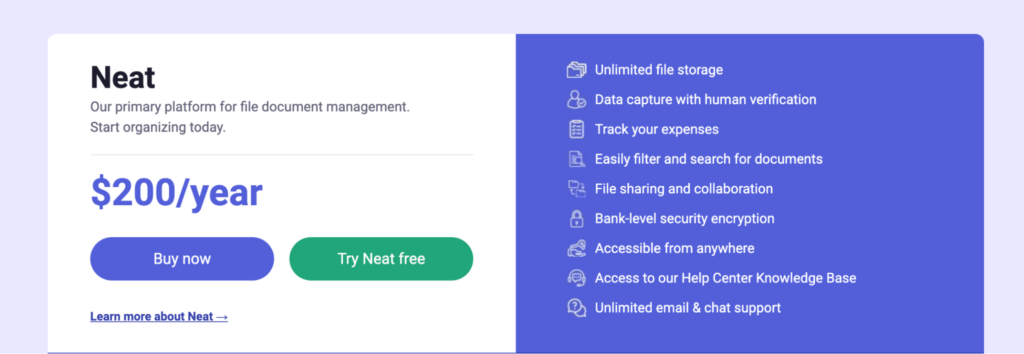

Pricing

- Basic: The basic subscription costs $200 per year (making it about $16/month) and includes unlimited file storage, data capture with human verification, expense tracking, file sharing, and bank-level security encryption. The subscription also allows for integration with several other software like QuickBooks, HR Block, Quicken, and more.

- Vip: For those who want to enhance their subscription, Neat offers a VIP service for an additional $50 per year. This premium service includes 1:1 training guided by Neat experts, a dedicated support team, early access to new features, and exclusive offers.

- Automated Insights: For businesses seeking real-time accounting and expense reporting, Neat’s Automated Insights subscription is a great option at an additional cost of $150 per year. This subscription includes features like import of bank account activity, automatic accounting reports, real-time insights and trends, and the ability to pair receipts with expenses. Additionally, users can send custom invoices and receive online payments.

Pros

- Easy to set up

- Convenient receipt management with the ability to take a picture of the receipt and save it as a PDF

- Searchable nature of documents and mobile app access for remote use

- Provides most of the functions needed to run a small business

Cons

- Incessant logins required

- Software times out too quickly

- Slow processing of larger number of page scans

- Insufficient customer support

Quick Summary

Who’s it for?: Small and medium-sized businesses who are looking for a cost-effective, efficient, and user-friendly solution to manage their finances.

How much it costs: Plans start at $200/year ($16/month)

Key features:

- Income and expense tracking

- Customizable invoices and quotes

- Bank connectivity

- GST/VAT tracking

- Insights and reports

- Receipt capture and organization

- Progress invoicing

- Bill and payment management

5. OnPay

Best For Streaming Payroll

Coming in hot at number 3 on my list of kickass accounting software solutions is OnPay! Designed with small business owners in mind, this software is perfect for those who are tired of manually processing payroll taxes and dealing with the headaches that come with it.

OnPay offers a simple, user-friendly interface that allows you to easily manage employee information, track hours, and generate paychecks. And if you’re worried about compliance with tax laws and regulations, fear not – OnPay has got you covered. It even caters to those with unique needs, like restaurants, farms, and churches.

Say goodbye to the days of manual payroll processing and hello to the wonders of automation with OnPay. Trust me, your employees (and your sanity) will thank you for it.

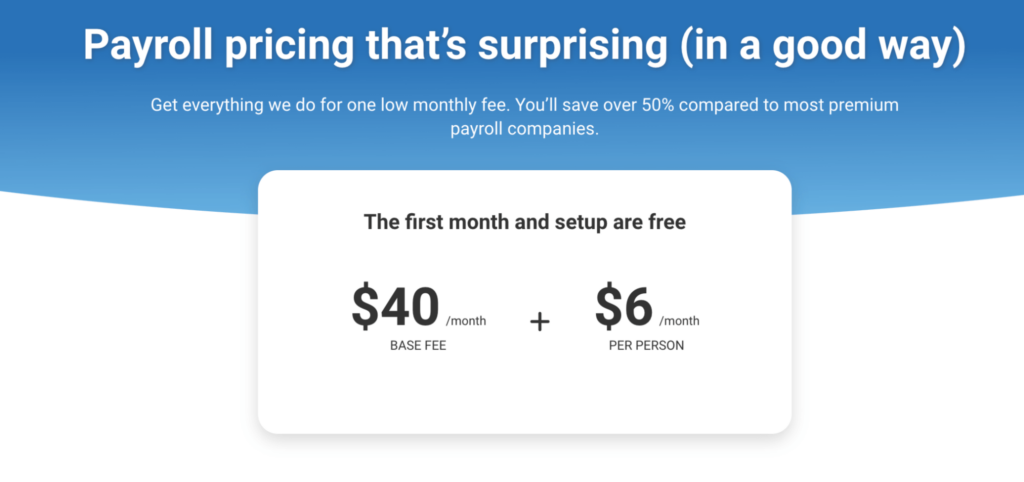

Pricing

OnPay offers a comprehensive payroll service that covers everything you need at a surprisingly affordable price. With a low monthly fee of $40 plus an additional fee of $6 per person per month, you’ll save over 50% compared to most premium payroll companies.

What’s even better is that OnPay offers the first month and setup for free, so you can try their services without any commitment. The pricing is transparent and straightforward, so you’ll know exactly what you’re paying for.

Pros

- Comprehensive payroll services are offered at an affordable price, making it an excellent choice for small to medium-sized businesses

- OnPay allows for the creation of payrolls on multiple schedules, providing flexibility to meet the needs of various companies

- The platform offers full customer support online or over the phone, ensuring that users can receive assistance whenever they need it

Cons

- OnPay does not have a mobile app, making it less convenient for those who prefer to manage their payroll on the go

- The platform is not recommended for companies with employees outside the U.S., as it only supports payroll processing for U.S. employees

Quick Summary

Who’s it for?: Small and medium-sized businesses seeking an easy-to-use platform for handling their payroll needs.

How much it costs: Plans start at $40/month.

Key features:

- Employee time tracking

- Automated payroll processing

- Direct deposit and pay stubs

- Business tax returns calculation and filing

- Customizable pay schedules

- Employee self-service portal

- Benefits and deductions management

- Compliance and reporting tools

6. Webgility

Best For Ecommerce Accounting

Webgility‘s ecommerce accounting for startups solution is the ultimate tool in your arsenal to conquer the world of online sales. Sync your orders to QuickBooks, track returns and refunds, and manage taxes like you’ve been slaying accounting since the day you were born.

Offering incredible ecomm features like syncing multi-channel inventory, managing product listings across all channels, and automating purchase orders based on inventory levels or shipping preferences.

You can also streamline order management from all your channels in a single dashboard, edit, delete and process payments like a rockstar, and automatically sync orders across multiple sales channels.

Don’t let the competition get the best of you. Sign up for Webgility now and show them who’s the real boss in ecommerce accounting!

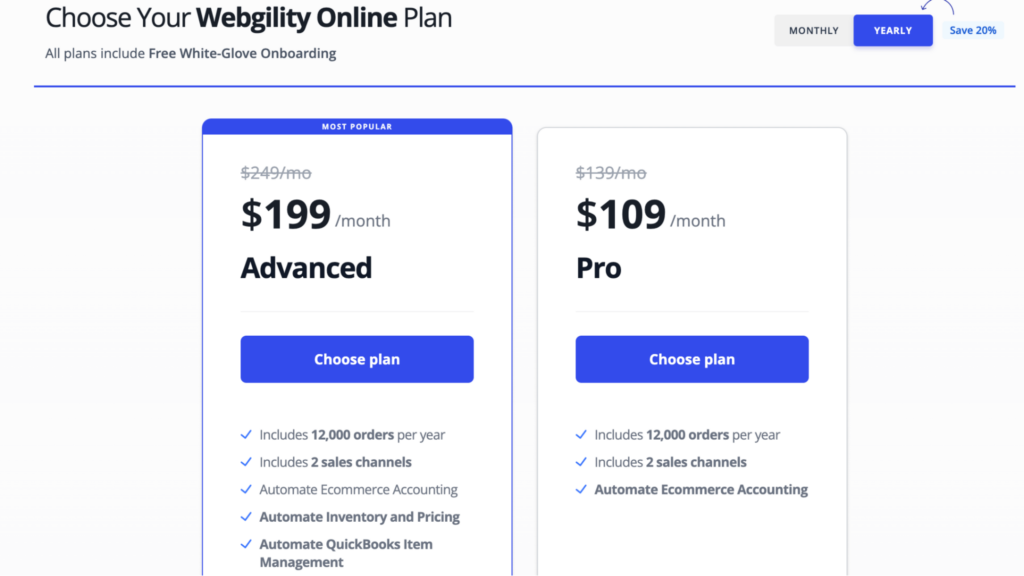

Pricing

- The Pro Plan: At $109/month The Pro Plan is designed for businesses that want to simplify their ecommerce accounting. With support for 12,000 orders per year and integration with 2 sales channels, this plan streamlines your accounting processes by automating data entry, invoice generation, and financial reporting.

- The Advanced Plan: The Advanced Plan costs 199$ and is perfect for businesses looking for comprehensive ecommerce management. In addition to the features offered in the Pro Plan, the Advanced Plan provides automation for inventory and pricing, allowing you to sync stock levels and price changes across multiple channels. Moreover, this plan includes automated QuickBooks item management, ensuring seamless integration with your accounting software.

Pros

- Streamlines ecommerce accounting processes

- Automation of inventory and pricing management

- Syncs stock levels and price changes across multiple channels

- Efficient integration with popular sales channels

- Comprehensive reporting and insights for better decision-making

- Free White-Glove Onboarding for smooth setup and implementation

Cons

- Limited flexibility in plan customization

- Potential steep learning curve for some users

- Possible delays in response from customer support

- Inadequate communication regarding billing and renewal policies

- Occasional software bugs and compatibility issues

- Limited scalability for businesses experiencing rapid growth

- May not meet the specific needs of certain niche industries

Quick Summary

Who’s it for?: Small to medium-sized businesses looking for reliable and efficient software to manage their e-commerce operations and financials..

How much it costs: Plans start at $109/month.

Key features:

- Multi-channel e-commerce integration

- Order management

- Inventory tracking

- Accounting and financial management

- Automated financial data entry and reconciliation

- Reports and analytics

- Customizable workflows

- Integrations with popular marketplaces and shopping carts

7. Gusto

Best For Payroll Automation

Gusto is one of the best accounting software for startups and small businesses looking to simplify their payroll and benefits administration.

Gusto takes care of everything from processing payroll for your employees and contractors, to managing employee benefits like health insurance and retirement plans. And that’s not all, this platform also offers some sweet extras like automated charitable donations and a wallet feature that gives employees more control over their money.

So if you want to save time and money, and get back to doing what you do best, then Gusto is the answer to your payroll and HR problems.

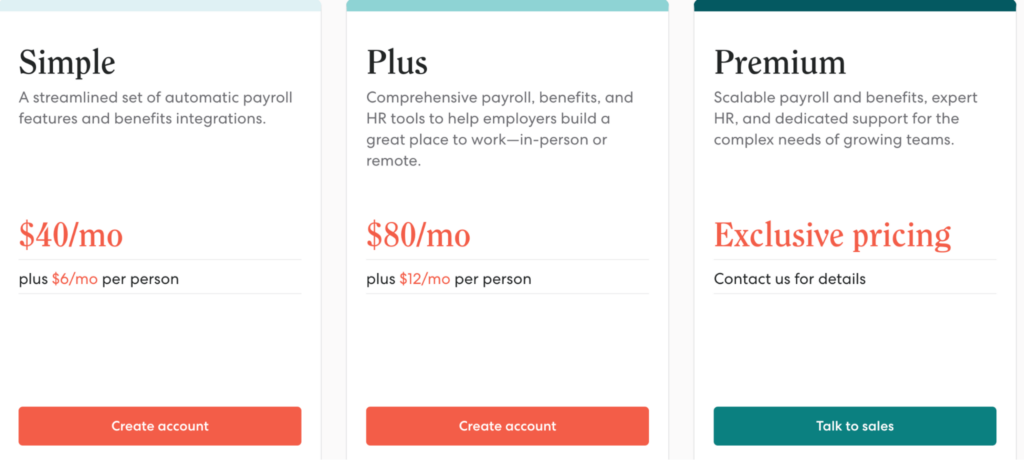

Pricing

- The Simple Plan: The Simple plan costs $40 per month plus $6 per person and includes full-service single-state payroll, employee profiles, basic hiring and onboarding tools, Gusto-brokered health insurance administration, employee financial benefits, payroll and time-off reports, custom admin permissions, and integrations for accounting, time tracking, expense management, and more.

- The Plus Plan: The Plus plan costs $80 per month plus $12 per person and includes everything in the Simple plan, plus full-service multi-state payroll, next-day direct deposit, advanced hiring and onboarding tools, PTO management and policies, time tracking and project tracking, workforce costing and reports, team management tools, and full support.

They also offer priority support and HR services add-on for $8 per person per month and a Premium plan for growing teams with exclusive pricing that requires contacting Gusto directly for details.

Pros

- Gusto simplifies employee and contractor payroll, making it easy for small businesses to manage

- The platform offers automatic tax filing and compliance guidance, saving businesses time and effort

- Gusto includes integrated free checking and high-yield savings accounts with paycheck advance options for employees

Cons

- Gusto's per-person pricing can become expensive as a business grows

- The platform lacks invoicing and accounts receivable features, which may be inconvenient for some businesses

Quick Summary

Who’s it for?: Businesses of various industries and sizes, including startups, freelancers, and established companies seeking an easy-to-use platform for handling their payroll needs.

How much it costs: Plans start at $40/month.

Key features:

- Automated payroll processing

- Employee time tracking

- Tax calculation and filing

- Direct deposit and pay stubs

- Customizable pay schedules

- Employee self-service portal

- Benefits and deductions management

- Compliance and reporting tools

8. Patriot

Best For Accounting And Payroll Integration

Patriot is the secret weapon for American businesses and accountants alike. This software is so easy to use that even non-accountants can handle it. But don’t let the simplicity fool you – this software has some powerful capabilities that’ll make any accountant drool.

Patriot Premium Accounting is the ultimate deal, offering unlimited users with permissions at no additional cost. And let’s talk about invoicing – you can customize your templates to match your brand and send them to customers like a boss. Plus, you can pay unlimited vendors and 1099 contractors and keep track of every single dollar that comes in and out of your business.

The best part? It’s way more affordable than other options out there. No more dealing with clunky, overpriced QuickBooks software that adds things you didn’t even ask for. Patriot keeps it simple and straightforward.

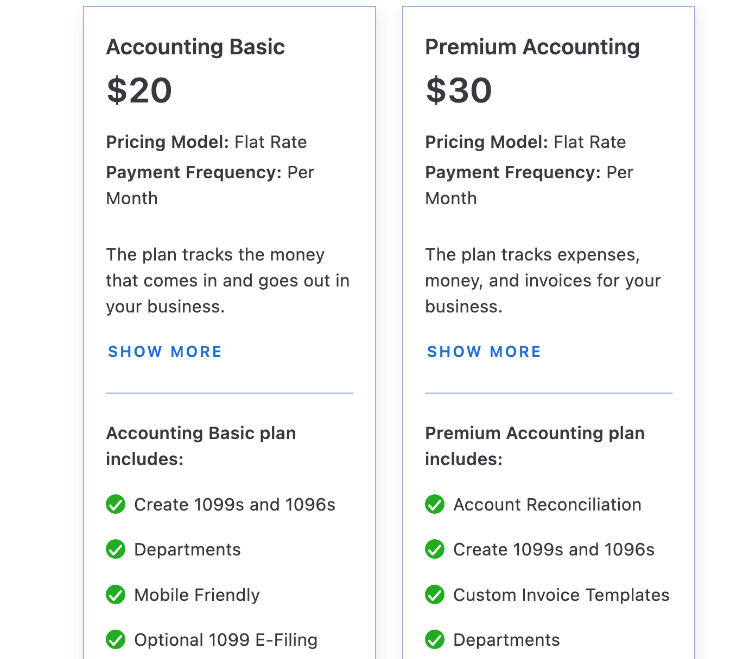

Pricing

- Accounting Basic: Patriot’s Accounting Basic plan, priced at $20 per month, is a cost-effective solution for small businesses looking to manage their finances. This plan includes features such as the ability to create 1099s and 1096s, departments to organize transactions, and mobile-friendly access. The optional 1099 E-filing feature and payroll integration also provide added convenience for businesses.

- Premium Accounting: For those who require more advanced accounting features, Patriot’s Premium Accounting plan, priced at $30 per month, is a great option. This plan includes everything in the Accounting Basic plan, as well as account reconciliation, custom invoice templates, and invoice payment reminders. The Premium Accounting plan is ideal for businesses that need to track expenses, money, and invoices in a streamlined and efficient manner.

Pros

- Convenient for on-the-go accounting and payroll management

- User-friendly and easy to navigate, even for those with little accounting experience

- Competitive pricing compared to other accounting software options

- Good range of integrations with other business tools and services

- The reporting features are comprehensive and provide valuable insights into the financial health of the business

- The support team is very responsive and helpful, with quick turnaround times for inquiries and issues

Cons

- Lack of a comprehensive report to show daily/weekly/monthly gross income per employee

- Learning curve to set up the software

Quick Summary

Who’s it for?: Small to medium-sized businesses looking for a user-friendly and affordable accounting software with payroll functionality.

How much it costs: Plans start at $20/month.

Key features:

- Easy-to-use platform for tracking income and expenses

- Payroll processing with direct deposit and pay stubs

- Department tracking

- Customizable invoice templates

- Account reconciliation

- Optional 1099 E-filing

- Mobile-friendly interface

- Great customer support

9. Melio

Best For Paying Vendors And Suppliers

Melio may not be the first online payment platform that comes to mind, but it’s certainly worth considering if you’re looking for a simpler way to manage your business bills and improve cash flow.

What sets Melio apart is its ability to pay vendors and contractors with bank transfers for free or by credit card, even in cases where cards aren’t typically accepted. This allows you to defer payments and hold onto your cash for longer, improving your cash flow.

Another advantage of Melio is that it doesn’t charge a monthly fee, and your vendors don’t need to sign up to receive payments. And with the ability to send and receive bank transfers for free, you can save on fees associated with other payment methods.

Overall, Melio provides a convenient and cost-effective solution for managing your business bills and cash flow. It may be last on my list of accounting tools for startups, but it’s certainly not the least.

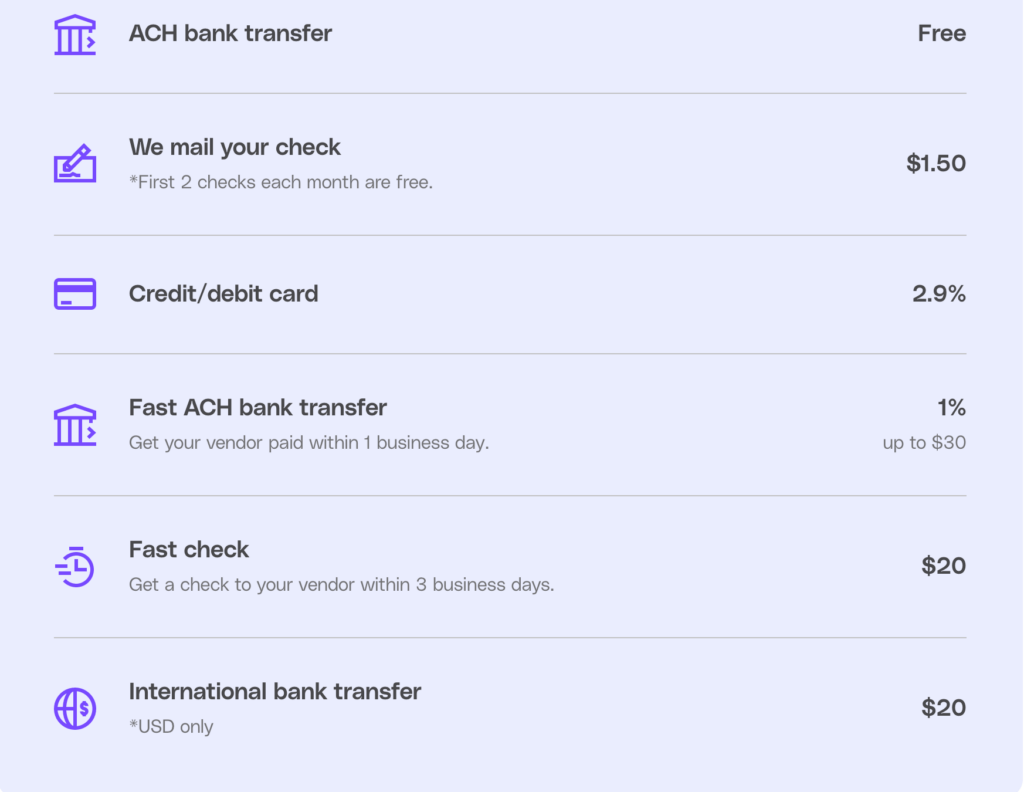

Pricing

Let’s talk money, honey! Melio gives you payment flexibility without the surprises. Send and receive ACH bank transfers for free, or choose from other payment methods that work best for your business. Want to mail a check? The first two each month are free, but after that, it’s just $1.50 per check. Need to pay by credit/debit card? It’s a flat 2.9% fee. For fast ACH transfers, it’s just 1%, up to $30. And if you need to send a fast check, it’s $20. Melio is transparent about its fees, so you’ll never be caught off guard. Plus, you can even earn cash back, rewards, and extra float on your business expenses when you pay with your credit card.

Pros

- Free ACH bank transfers with no subscription fees

- Syncs with popular accounting software like QuickBooks, Xero, and FreshBooks

- Allows for custom payment requests and easy bill capture

- Approval workflows and role-based permissions for added control

- Credit/debit card payments available for greater flexibility and rewards

Cons

- Fees for certain payment methods, such as mailed checks and international bank transfers

- Limited payment speed options for ACH transfers and checks

- No option for cash payments or physical card readers

- Customer support can be slow to respond at times

- Limited customization options for invoice templates and branding

Quick Summary

Who’s it for?: Small to medium-sized businesses looking for a flexible payment solution with a variety of payment options and free ACH bank transfers.

How much it costs: Melio is free to use for ACH bank transfers, with fees for mailed checks, credit/debit card payments, and expedited payment options ranging from $1.50 to $20.

Key features:

- Free ACH bank transfers

- Credit/debit card payments

- Fast ACH bank transfers and checks for a fee

- Accounting software sync with QuickBooks, Xero, FreshBooks, and Business Central

- Custom payment requests and approval workflows

- Cash flow control with credit card payments

- Customer and vendor portals for payment tracking and updates

Final Thoughts

In conclusion, there’s no need to let the stress of managing your startup’s finances keep you up at night. I’ve covered the best accounting software for startups, offering a range of features to help you keep your accounting in order and your business on track.

So whether you’re struggling with payroll, inventory management, or tax preparation, there’s a tool out there to help you streamline your operations and focus on what really matters: growing your business.

Don’t let outdated accounting practices hold you back. Embrace the power of technology and take your startup‘s finances to the next level. With these 9 kickass accounting software solutions, you’ll be able to streamline your financial management and make informed decisions to drive your startup’s success.

Am I missing any? Let me know in the comments below.

Cheers,

Alex